Inventory on hand are items that are physically present in the warehouse. The items can be finished products, components, or raw materials.

How do you check the inventory on hand?

2 methods can check the inventory on hand:

- Manual count

- You can manually count how many items are in your warehouse

- Calculation

- Total inventory quantity-items on the way

What are inventory days on hand?

Inventory days on hand means how many days these items are in the warehouse before you use them or sell them out. People refer to this term as DOH ( days inventory on hand). DOH is one of the major numbers to measure how efficiently the company handles its inventory.

How to calculate inventory days on hand? below is a popular method to calculate DOH

Average inventory/(Cost of goods sold/365 days )

For example a factory has an amont of inventory of 1million at day 1, and end up with a inventory of 0.2million at day 365, their cost of goods sold at this period is 4million. so their Avg. inventory is: (1+0.2)/2=0.6million. Their inventory days on hand is: 0.6/(4/365)=54.75 days

What are good days of inventory on hand?

There is not a certain number to measure good or bad DOH (days inventory on hand), because each company has its own accounting period, and each industry has its own special feature. For dairy products, 7 days of DOH is too long, but if it is for airplanes, ship manufacturers’ 7 months DOH is probably normal for them.

The rule of thumb is that the lower of DOH the better. The fewer days you have inventory on hand means you have less capital tied up on products. You also use less warehouse space, and fewer laborers to move these products around.

Inventory turnover

The inventory turnover ratio is another important financial number to measure how productively this company handles its inventory.

Inventory turnover ratio= COGS(Cost of goods sold)/average inventory in a period

For example a company’s COGS is $4 million for previous 6 months. their average inventory during that 6 months is $1 million, then their inventory turnover ration is 4/1=4. This company flips their inventory 4 times during these 6 months.

The higher the inventory turnover ratio the better. When a business has a high inventory turnover ratio means it can sell its goods fast. The lower inventory turnover ratio means the business has inventory sitting in its warehouse for a long time without moving. Their product does not sell well.

Is an inventory on hand an asset?

Yes, generally speaking, people consider inventory as an asset

Is an inventory on hand a liability?

Mostly, Inventory on hand is an asset unless you collect money from customers but has not shipped the product or you receive raw material, or parts from your suppliers but have not paid them, then these inventories are your liabilities.

Is an inventory on hand a non-current asset?

Inventory in general is considered to be a current asset. Inventory on hand is also a current asset. Most companies plan to sell their inventory during a short period of time, very rarely a company wants to hold their inventory for 3 or 5 years. Inventory on hand is a current asset.

What type of account is an inventory on hand?

Inventory on hand is in a current asset account

Below is a good video to explain inventory on hand and inventory turnover

Inventory VS. inventory on hand

4 main types of inventories are :

- Raw material

- Parts or components

- Work in process or WIP or incomplete products

- Finished products

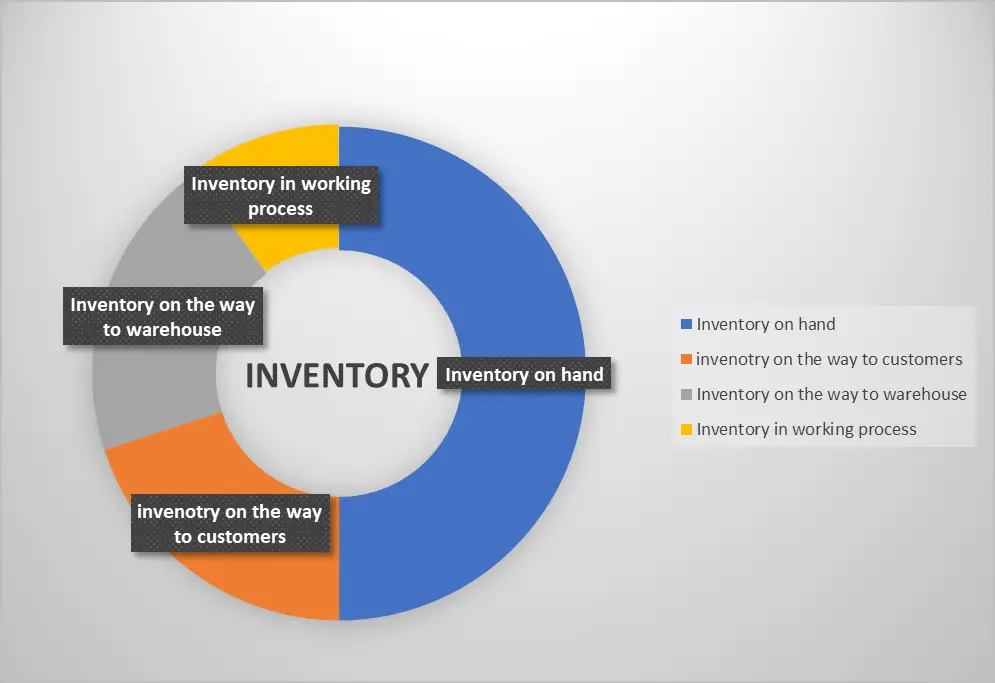

Inventory is a more broad term. Inventory includes inventory on hand, inventory on the way to the warehouse, inventory in the working process, and inventory on the way to customers. Below is a pie chart that better illustrates their relationships.

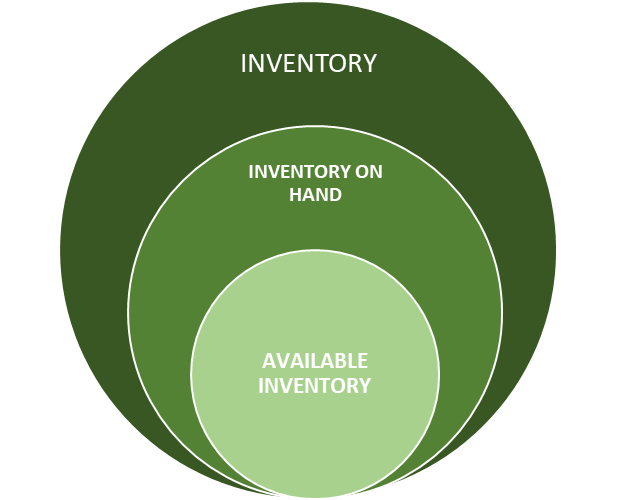

What does available inventory mean?

Available inventory means available inventory on hand

Available inventory= Inventory on hand – any committed or scheduled inventory

Committed inventory will be customers already purchased but your company has not shipped out

Schedule inventory will be parts, and raw materials that are already scheduled to use but are still in the warehouse

Inventory on hand VS. available

The inventory on hand quantity is always large than the available inventory quantity.

Inventory on hand includes the orders that are received but have not been fulfilled, and also parts already scheduled to use on products, etc. Available inventory means pure inventory on hand which is free to use.

2 types of inventory system

2 common types of inventory systems are periodic and perpetual inventory systems

- Periodic inventory system

- Count inventory periodically

- Rely on occasional manual count to keep track of inventory

- less book record

- less work

- Good for small inventory

- Perpetual inventory system

- Count inventory constantly

- keep track of inventory through daily update

- More bookkeeping

- Lots of work

- Good for big inventory

3 different inventory costing methods

3 vastly used inventory costing methods are FIFO, LIFO, and WAC

- FIFO

- First in, First out

- First acquired items will use or sell first

- More accurate cost keeping

- The majority of businesses use the FIFO inventory method

- Businesses like restaurants, wholesale, and grocery stores like the FIFO method

- LIFO

- Last in, first out

- The last acquired item will use or sell first

- Less accurate cost keeping

- Machinery and construction industries prefer the LIFO method

- WAC

- WAC means the weighted average cost

- The total cost of inventory divided by the total units of inventory equal to WAC

- Sophisticated businesses which are difficult to find individual unit cost

Below is a good video to explain FIFO, LIFO, and WAC

What is the average carrying cost of inventory?

The carrying cost of inventory is how much cost you to keep the inventory in your warehouse. The average carrying cost of inventory should be in the range of 15~30% of the total inventory value.

Carrying cost of inventory formula

Carrying cost of inventory %= (Total carrying cost/total inventory value)x100

What types of carrying costs you may have?

- Capital costs tied up with raw materials or parts

- Warehouse rent, utilities, insurance

- Warehouse labors

- Warehouse equipment